Listen up, folks, because this is big. The Nasdaq just took a hit after Powell dropped a major hint about the Fed's next moves. If you're invested in tech or following the stock market closely, this is something you don’t wanna miss. It’s not just numbers on a screen; it's a potential shift in how we're all thinking about money, growth, and risk.

Here's the deal: The Nasdaq Composite has been on a rollercoaster ride lately, and it just slid down after Jerome Powell, the guy in charge of the Federal Reserve, made some comments that sent shockwaves through Wall Street. People are buzzing about what this means for the future of tech stocks, interest rates, and the overall economy. So, buckle up because we're diving deep into this story.

This isn’t just another day in the market. The signals coming from Powell are like a weather forecast for investors—important, sometimes confusing, but crucial if you want to protect your portfolio. Whether you're a seasoned trader or someone just starting out, understanding what’s happening with the Nasdaq and why Powell’s words carry so much weight can make all the difference in your financial journey.

Read also:Ssis 641 The Ultimate Guide To Unlocking Its Potential

Why the Nasdaq Declines Matter

Alright, let's break it down. The Nasdaq isn't just any index—it's the pulse of the tech world. When it declines, it's like the canary in the coal mine for innovation-driven companies. But why does it matter so much? Well, the Nasdaq houses some of the biggest names in tech, like Apple, Microsoft, and Tesla. These aren’t just companies; they’re symbols of where the global economy is heading.

When the Nasdaq takes a dip, it’s often a reflection of broader economic concerns. Powell's signal? That’s like the cherry on top of an already complicated sundae. Investors are now asking themselves, “Is the party over for tech stocks?” Let’s find out.

What Exactly Did Powell Say?

Jerome Powell didn’t mince words. He hinted at potential interest rate hikes, which is like throwing a bucket of cold water on the stock market's face. Higher interest rates mean borrowing money gets more expensive, and that can slow down growth for companies, especially those in the tech sector that rely heavily on debt to fuel expansion.

Here’s the kicker: Powell’s comments weren’t entirely unexpected, but the timing and tone caught some investors off guard. It’s like when your teacher says there’s a pop quiz—everyone knows it’s coming, but the moment it happens, panic sets in. This is exactly what happened with the Nasdaq.

Impact on Tech Stocks

Let’s talk turkey here. Tech stocks are the lifeblood of the Nasdaq, and when Powell talks about raising interest rates, it’s like pulling the rug out from under them. These companies often operate with slim margins and rely on future earnings to justify their sky-high valuations. Higher rates? That’s a recipe for recalibration.

Here’s a quick rundown of how different sectors within tech might be affected:

Read also:Joseph Z Net Worth Forbes The Inside Scoop On His Financial Empire

- Big Tech Giants: Companies like Apple and Microsoft may weather the storm better due to their strong balance sheets, but even they aren’t immune to market sentiment.

- Startups and Growth Stocks: These are the ones that could get hit the hardest. Without access to cheap capital, scaling becomes a lot tougher.

- Electric Vehicle Makers: Tesla and other EV companies might see a slowdown in investor enthusiasm as risk appetite decreases.

Long-Term vs. Short-Term Pain

Now, here’s the million-dollar question: Is this a short-term blip, or are we looking at long-term pain for the Nasdaq? Historically, markets tend to recover, but the road to recovery isn’t always smooth. In the short term, volatility is likely to continue as investors digest Powell’s message and adjust their strategies.

On the flip side, some analysts argue that higher interest rates could actually lead to healthier, more sustainable growth in the long run. It’s like pruning a tree—painful in the moment, but beneficial in the long term.

Market Reaction and Investor Sentiment

The market’s reaction to Powell’s signal was swift and brutal. Traders hit the sell button hard, and the Nasdaq plummeted. But what does this tell us about investor sentiment? It shows that confidence in the market is fragile right now. Any hint of uncertainty from the Fed can send investors running for the hills.

Here’s the thing: Investors are caught between two worlds. On one hand, they want growth and innovation, which the tech sector provides in spades. On the other hand, they’re wary of the risks that come with high valuations and uncertain economic conditions. It’s a delicate balancing act.

Key Players in the Decline

Not all stocks in the Nasdaq are created equal. Some companies are taking a bigger hit than others. Here are a few names to watch:

- Meta Platforms: Facebook’s parent company is feeling the pinch as ad revenue slows down.

- Amazon: E-commerce giant Amazon is under pressure as consumers tighten their belts.

- NVIDIA: The chipmaker is seeing a decline as demand for gaming and AI hardware softens.

What Does This Mean for the Economy?

The Nasdaq isn’t just a stock index; it’s a barometer for the health of the U.S. economy. When it declines, it’s a sign that something might be off. Powell’s signal about interest rates is a direct attempt to cool down inflation, but it comes with trade-offs. Higher rates can slow economic growth, which is a concern for everyone, not just investors.

For the average person, this could mean higher mortgage rates, more expensive car loans, and increased credit card interest. It’s a ripple effect that touches every corner of the economy. So, while the Nasdaq decline might seem like a Wall Street problem, it’s actually a Main Street issue too.

How Inflation Fits Into the Picture

Inflation has been the elephant in the room for quite some time now. The Fed’s decision to raise rates is all about bringing inflation under control. But here’s the tricky part: too much tightening can lead to a recession. It’s like walking a tightrope— Powell and his team are trying to strike the perfect balance.

For investors, this means keeping a close eye on inflation data. Any signs of a slowdown could be a green light for the Fed to ease up on rate hikes, which could, in turn, give the Nasdaq a boost.

Historical Context and Lessons Learned

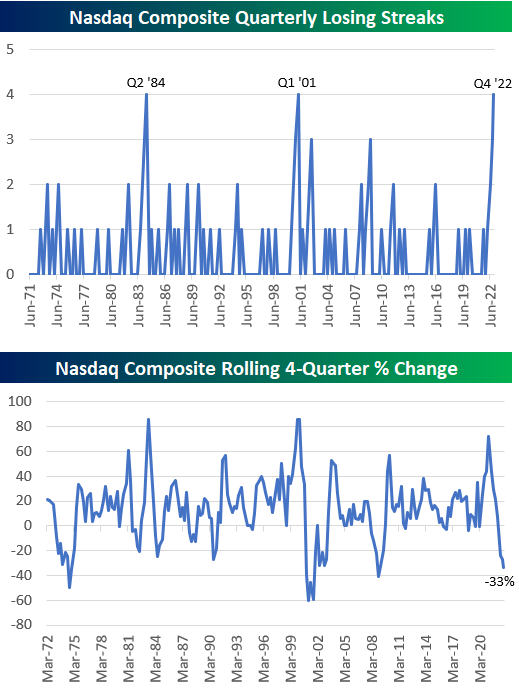

History has a funny way of repeating itself. If we look back at past instances where the Fed raised interest rates, we can see patterns that might help us understand what’s happening today. For example, during the dot-com bubble burst in the early 2000s, tech stocks took a massive hit. Sound familiar?

But here’s the thing: history doesn’t repeat itself exactly. The market today is different from what it was 20 years ago. We have new technologies, new players, and new challenges. While we can draw lessons from the past, we can’t rely on them entirely to predict the future.

Comparing Past Declines to Today’s Market

Let’s compare the current Nasdaq decline to some of the biggest market crashes in history:

- Dot-Com Bubble (2000): Tech stocks imploded after a speculative frenzy.

- Great Recession (2008): The entire financial system was on the brink of collapse.

- Pandemic Crash (2020): Markets tanked due to uncertainty surrounding COVID-19.

Each of these events had unique causes and consequences, but they all share one common thread: the market eventually recovered. Will this time be different? Only time will tell.

Strategies for Investors

So, what’s an investor to do in the face of uncertainty? The key is to stay informed and strategic. Here are a few tips to help you navigate the choppy waters:

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different sectors and asset classes.

- Focus on Fundamentals: Look for companies with strong fundamentals and sustainable growth prospects.

- Stay Patient: Markets can be volatile in the short term, but over the long term, they tend to reward patient investors.

Remember, investing is a marathon, not a sprint. Don’t let short-term declines derail your long-term goals.

When to Buy, When to Sell

Timing the market is nearly impossible, but there are signs you can watch for. If you see a stock you like at a bargain price, it might be worth considering a buy. Conversely, if a stock’s fundamentals have changed drastically, it might be time to sell. Always do your research and consult with a financial advisor if you’re unsure.

Final Thoughts and Call to Action

Alright, folks, that’s the scoop on the Nasdaq decline and Powell’s signal. The market is in flux right now, but that’s not necessarily a bad thing. It’s an opportunity to reassess your investments, refine your strategy, and position yourself for long-term success.

Here’s a quick recap of what we covered:

- Powell’s comments about interest rates sent the Nasdaq tumbling.

- Tech stocks are particularly vulnerable to rate hikes.

- The market’s reaction reflects broader economic concerns.

- History provides lessons, but the future remains uncertain.

Now, it’s your turn to take action. Leave a comment below and let me know what you think about the Nasdaq decline. Are you bullish, bearish, or somewhere in between? And don’t forget to share this article with your friends and fellow investors. Knowledge is power, and together, we can navigate these uncertain times.

Stay sharp, stay informed, and most importantly, stay invested in your future. Until next time!

Table of Contents

- Why the Nasdaq Declines Matter

- What Exactly Did Powell Say?

- Impact on Tech Stocks

- Long-Term vs. Short-Term Pain

- Market Reaction and Investor Sentiment

- Key Players in the Decline

- What Does This Mean for the Economy?

- How Inflation Fits Into the Picture

- Historical Context and Lessons Learned

- Comparing Past Declines to Today’s Market

- Strategies for Investors

- When to Buy, When to Sell

- Final Thoughts and Call to Action