Let’s talk about dead cat bounce—a term that sounds as morbid as it is intriguing. If you’re scratching your head wondering what this financial phrase means, don’t worry, you’re not alone. Dead cat bounce is one of those terms that makes you pause and think, “Wait, what?” But trust me, once you understand it, you’ll see how it plays a crucial role in the stock market world. So buckle up, because we’re diving deep into the fascinating world of finance.

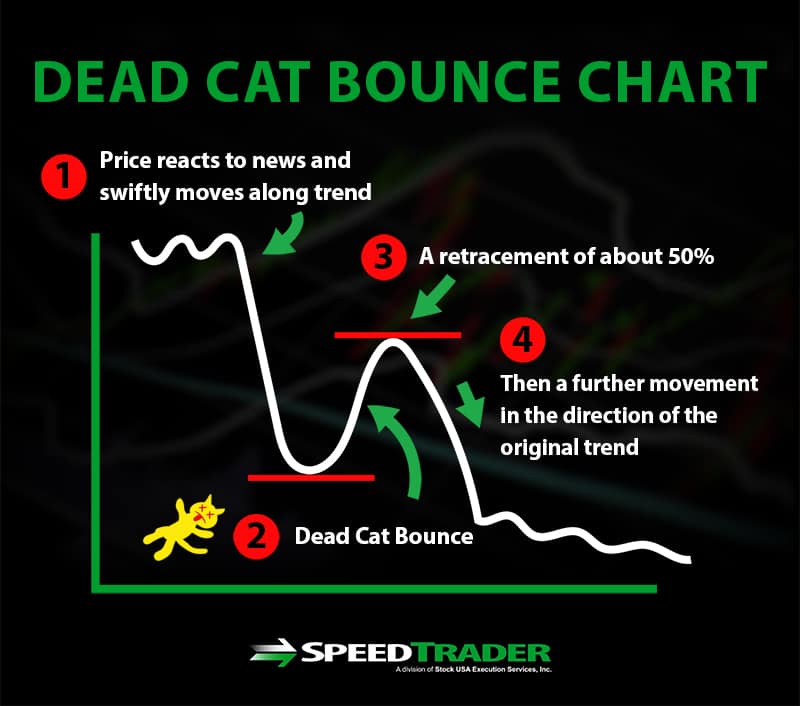

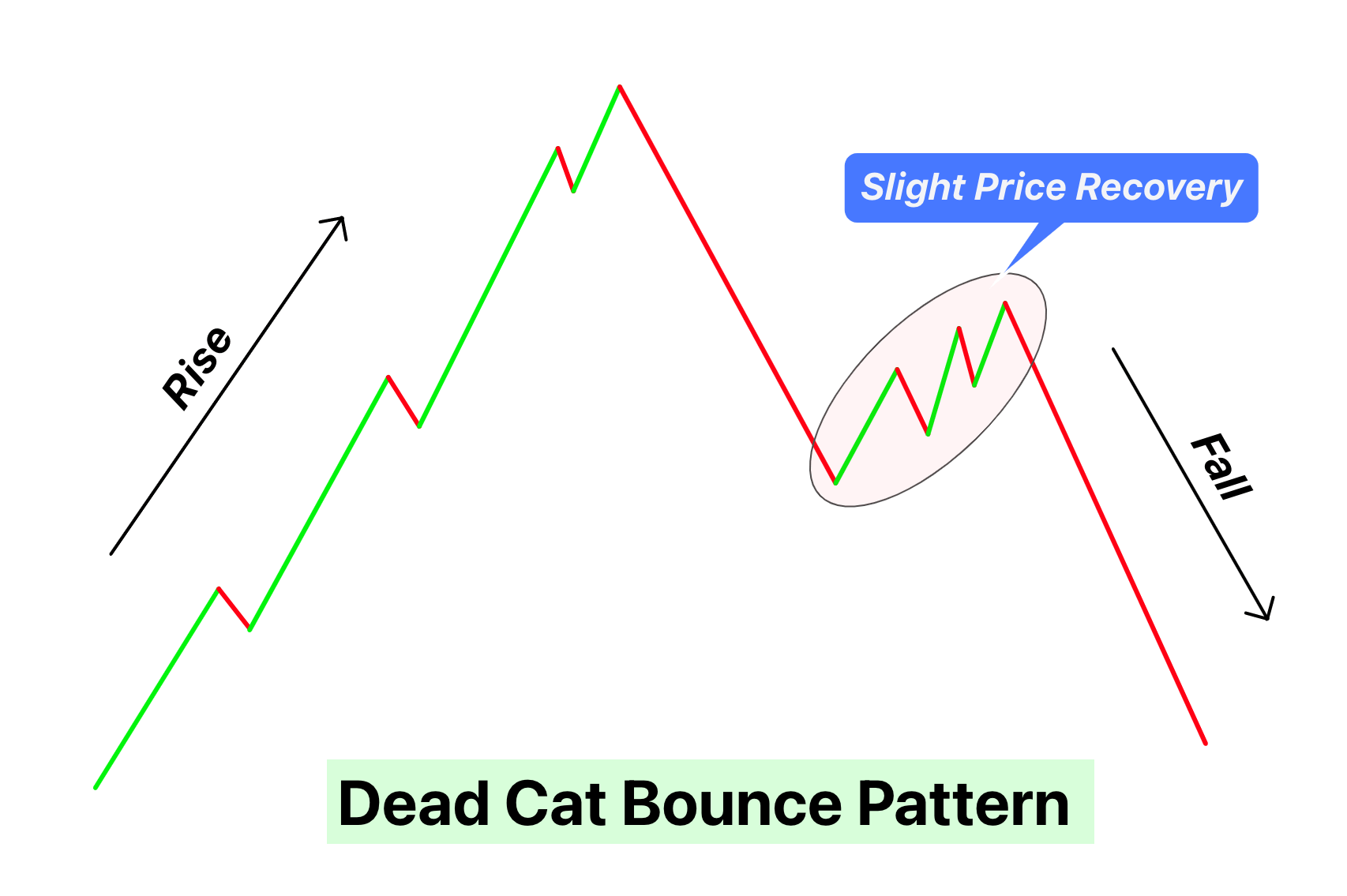

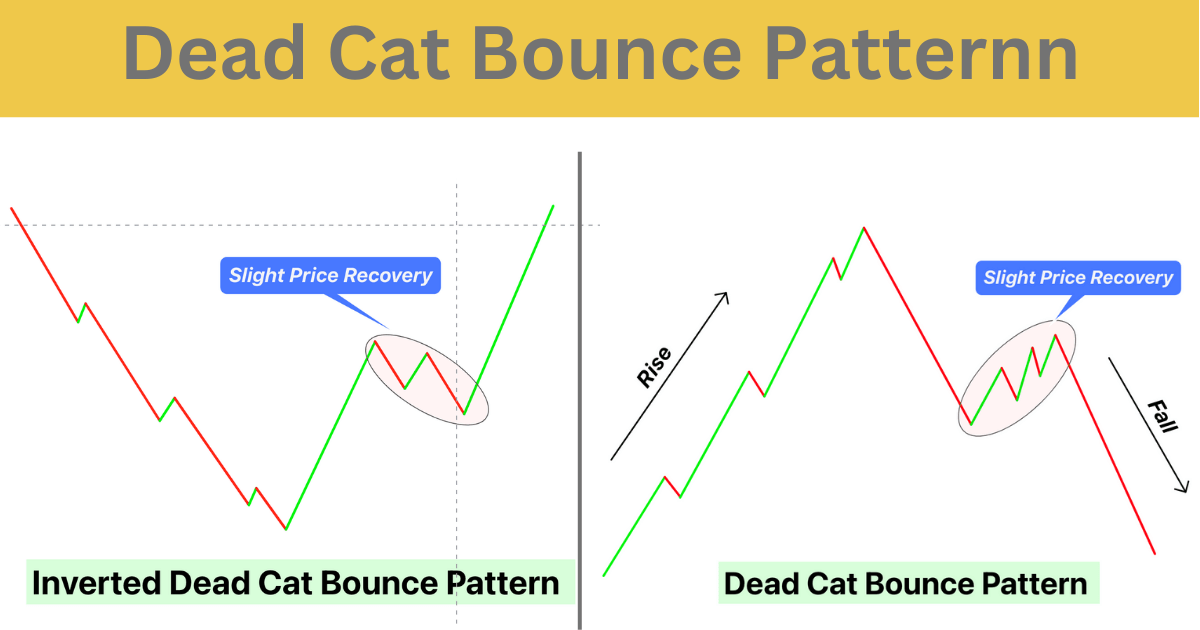

Now, before we get too far ahead of ourselves, let’s break it down. Dead cat bounce refers to a temporary recovery in the price of a stock or market after a significant decline. Think of it like this: imagine a cat falling from a great height. Even if it’s dead, it might still bounce when it hits the ground. In the stock market, this bounce represents a brief uptick in prices, but it doesn’t mean the asset is actually recovering. It’s more like a false hope before the inevitable decline continues.

Why should you care? Well, understanding dead cat bounce can help you make smarter investment decisions. Whether you’re a seasoned trader or just starting out, knowing when a bounce is real or fake can save you a lot of money—and headaches. So, let’s dive into the details and explore why this concept matters so much.

Read also:Kevin Gates The Untold Story Of A Rising Hiphop Star

Here’s a quick roadmap of what we’ll cover:

- What is dead cat bounce?

- How to identify a dead cat bounce

- Examples of dead cat bounce in action

- Why dead cat bounce happens

- How to avoid getting caught in a dead cat bounce

- Dead cat bounce vs. real recovery

- Impact on long-term investments

- Psychology behind dead cat bounce

- Tools and resources for spotting dead cat bounce

- Final thoughts on dead cat bounce

What is Dead Cat Bounce?

Alright, let’s start with the basics. Dead cat bounce is a term used to describe a temporary increase in the price of a stock or market after a steep decline. It’s not a true recovery; rather, it’s a short-lived rally that tricks investors into thinking the worst is over. The term itself is a bit grim, but it’s meant to emphasize the point that just because something bounces, it doesn’t mean it’s alive or healthy.

In the stock market, dead cat bounce often occurs when investors buy a falling stock in anticipation of a rebound. However, these buyers are usually wrong, and the stock continues its downward trend after the brief uptick. This phenomenon can happen in individual stocks, entire markets, or even commodities.

So, how does it work? Let’s say a company’s stock has been plummeting for weeks due to poor earnings reports or bad press. Some investors might see the low price as an opportunity and start buying the stock, thinking it’s a bargain. This sudden influx of buyers can temporarily drive the price up, creating a dead cat bounce. But if the underlying issues aren’t resolved, the stock will eventually resume its decline.

Why the Term “Dead Cat Bounce”?

Now, you might be wondering why anyone would come up with such a morbid term. Well, the phrase originated in the financial world as a way to describe the futility of trying to revive something that’s already dead. Just like a dead cat falling from a height might still bounce when it hits the ground, a dying stock might still show some life before it ultimately fails. It’s a vivid metaphor that stuck, and now it’s a widely recognized term in the investment community.

How to Identify a Dead Cat Bounce

Identifying a dead cat bounce can be tricky, especially for new investors. But with the right tools and knowledge, you can spot the difference between a genuine recovery and a false one. Here are some key indicators to look out for:

Read also:Claude Akins The Forgotten Hollywood Legend Who Shaped The Industry

- Short-Term Gains: A dead cat bounce typically results in a quick spike in price, followed by a return to the previous downward trend.

- Lack of Fundamental Improvements: If the underlying issues causing the decline haven’t been addressed, it’s likely a dead cat bounce rather than a real recovery.

- Increased Trading Volume: A sudden surge in trading volume during a bounce can indicate that investors are jumping in, hoping for a rebound.

- Technical Indicators: Tools like moving averages and RSI (Relative Strength Index) can help you identify whether a bounce is sustainable or not.

Remember, the key is to look beyond the surface. Just because a stock is bouncing doesn’t mean it’s out of the woods. Always dig deeper and analyze the fundamentals before making any investment decisions.

Examples of Dead Cat Bounce in Action

To better understand dead cat bounce, let’s look at some real-world examples. One of the most famous cases occurred during the 2008 financial crisis. Many banks and financial institutions saw their stock prices plummet as the crisis unfolded. However, there were occasional rallies where prices would temporarily spike, only to fall again as the reality of the situation set in.

Another example is the dot-com bubble burst in the early 2000s. During this time, many tech companies saw their stock prices soar, only to crash when the bubble burst. Some of these stocks experienced brief recoveries, but they eventually continued their downward trajectory as investors realized the companies weren’t sustainable.

These examples highlight the importance of staying vigilant and not getting caught up in the hype of a bounce. What might seem like a recovery could actually be a dead cat bounce in disguise.

Why Dead Cat Bounce Happens

So, why does dead cat bounce occur? There are several reasons:

- Emotional Trading: Investors often act on emotions rather than logic. When they see a stock price falling, some might buy in the hope of catching a bargain, leading to a temporary price increase.

- Short Covering: Short sellers might close their positions when a stock price drops too low, causing a temporary rise in price.

- Market Sentiment: Sometimes, positive news or rumors can create a brief rally, even if the underlying fundamentals haven’t changed.

Understanding these factors can help you anticipate when a dead cat bounce might occur and avoid falling into its trap.

The Role of Market Psychology

Psychology plays a huge role in the stock market, and dead cat bounce is no exception. Investors are often swayed by fear and greed, leading them to make irrational decisions. When a stock price falls, some investors might panic and sell, while others might see it as an opportunity to buy. This push and pull can create the illusion of a recovery, even when none exists.

How to Avoid Getting Caught in a Dead Cat Bounce

Now that you know what dead cat bounce is and why it happens, let’s talk about how to avoid getting caught in one. Here are some tips:

- Do Your Research: Always analyze the fundamentals of a stock before investing. Look at factors like earnings reports, debt levels, and industry trends.

- Use Technical Analysis: Tools like moving averages and RSI can help you identify whether a bounce is sustainable or not.

- Set Stop-Loss Orders: If you do decide to invest in a bouncing stock, set a stop-loss order to limit your potential losses.

- Stay Calm: Don’t let emotions cloud your judgment. Stick to your investment strategy and avoid making impulsive decisions.

By following these tips, you can minimize the risk of falling victim to a dead cat bounce and make more informed investment decisions.

Dead Cat Bounce vs. Real Recovery

One of the biggest challenges in the stock market is distinguishing between a dead cat bounce and a real recovery. Here are some key differences:

- Duration: A dead cat bounce is usually short-lived, while a real recovery tends to be more sustained.

- Fundamentals: A real recovery is often backed by improvements in the company’s financial health, whereas a dead cat bounce isn’t.

- Volume: A real recovery might see a gradual increase in trading volume, while a dead cat bounce often has a sudden spike followed by a decline.

By comparing these factors, you can better gauge whether a bounce is genuine or not.

Impact on Long-Term Investments

Dead cat bounce can have a significant impact on long-term investments. If you’re holding a stock that experiences a bounce, it’s important to evaluate whether it’s a true recovery or just a temporary uptick. If it’s the latter, you might want to consider cutting your losses and moving on. On the other hand, if the bounce is part of a larger recovery trend, you might want to hold onto the stock and wait for it to fully recover.

Long-term investors should focus on the fundamentals and not get swayed by short-term fluctuations. Dead cat bounce is just one of the many challenges you’ll face in the market, but with the right approach, you can navigate it successfully.

Psychology Behind Dead Cat Bounce

As we mentioned earlier, psychology plays a big role in dead cat bounce. Investors are often influenced by emotions like fear, greed, and hope. When a stock price falls, some might panic and sell, while others might see it as an opportunity to buy. This emotional tug-of-war can create the illusion of a recovery, even when none exists.

Understanding these psychological factors can help you make more rational investment decisions. By staying calm and focusing on the fundamentals, you can avoid getting caught up in the hype of a dead cat bounce.

How to Overcome Emotional Bias

Here are some strategies to help you overcome emotional bias:

- Stick to Your Plan: Have a clear investment strategy and stick to it, no matter what the market does.

- Use Data-Driven Decisions: Rely on data and analysis rather than emotions when making investment decisions.

- Seek Advice: Consult with financial advisors or join investment groups to get a second opinion.

Tools and Resources for Spotting Dead Cat Bounce

There are several tools and resources available to help you spot dead cat bounce:

- Technical Indicators: Use tools like moving averages, RSI, and MACD to analyze price trends.

- News Aggregators: Stay updated on the latest news and developments affecting the stocks you’re interested in.

- Investment Platforms: Many platforms offer tools and resources to help you analyze stocks and make informed decisions.

By leveraging these tools, you can better identify dead cat bounce and make smarter investment choices.

Final Thoughts on Dead Cat Bounce

In conclusion, dead cat bounce is a fascinating and important concept in the stock market. Understanding it can help you avoid making costly mistakes and make more informed investment decisions. Remember, just because a stock is bouncing doesn’t mean it’s out of the woods. Always do your research, analyze the fundamentals, and stay calm in the face of market fluctuations.

So, the next time you see a stock price bouncing back after a steep decline, take a step back and evaluate whether it’s a real recovery or just a dead cat bounce. And if you’re unsure, don’t hesitate to seek advice from a financial expert.

Got any questions or thoughts? Drop a comment below and let’s keep the conversation going. And don’t forget to share this article with your friends and fellow investors. Together, we can all become smarter and more successful in the world of finance.