When it comes to investing in the stock market, QQQ stock price is a topic that sparks curiosity among both seasoned investors and newcomers alike. If you're looking to understand what makes QQQ tick and how its price movements can impact your portfolio, you've come to the right place. In this article, we’ll break down everything you need to know about QQQ stock price in a way that’s easy to digest, even if you’re not a finance guru. So, grab a cup of coffee, sit back, and let’s dive in!

Now, you might be wondering, "What exactly is QQQ?" Well, buckle up because we’re about to take you on a journey through the world of exchange-traded funds (ETFs). QQQ is no ordinary ETF; it’s one of the most popular and widely traded ETFs globally. It tracks the Nasdaq-100 Index, which includes some of the biggest tech giants like Apple, Microsoft, and Tesla. So, yeah, it’s kind of a big deal.

But why should you care? The QQQ stock price isn’t just a number on a screen. It reflects the health of the tech sector, the broader market, and even global economic trends. Whether you’re a day trader trying to make quick bucks or a long-term investor looking to build wealth, understanding QQQ can give you an edge. And that’s exactly what we’re here for—to give you the tools and knowledge to make smarter investment decisions.

Read also:Is Barron Trump The Antichrist Exploring The Myths Facts And Conspiracy Theories

What is QQQ Stock Price and Why Should You Care?

Let’s start with the basics. QQQ stock price refers to the market price of the Invesco QQQ Trust, an ETF that mirrors the performance of the Nasdaq-100 Index. Think of it as a basket of stocks that includes 100 of the largest non-financial companies listed on the Nasdaq Stock Market. These companies are predominantly tech-heavy, which means QQQ is heavily influenced by the performance of tech giants like Amazon, Facebook, and Google.

Here’s the kicker: QQQ isn’t just for tech enthusiasts. It’s a great way to gain exposure to the growth potential of the tech sector without having to pick individual stocks. And because it’s so liquid, it’s perfect for both short-term traders and long-term investors. But before you jump in, you need to understand what drives QQQ stock price and how it can impact your portfolio.

Factors Influencing QQQ Stock Price

So, what makes QQQ stock price move? There are several factors at play, and understanding them is key to making informed investment decisions. Let’s break it down:

- Performance of the Nasdaq-100 Index: Since QQQ tracks the Nasdaq-100, its price is directly influenced by the performance of the companies in the index. If the tech sector is booming, QQQ is likely to rise. Conversely, if there’s a downturn, QQQ could take a hit.

- Economic Indicators: Factors like interest rates, inflation, and GDP growth can all impact QQQ. For example, rising interest rates can hurt tech stocks because they tend to have higher valuations based on future growth prospects.

- Global Events: Geopolitical tensions, trade wars, and pandemics can all affect QQQ stock price. Remember how the market tanked during the early days of the pandemic? Yeah, QQQ felt that too.

- Corporate Earnings: The performance of the companies in the Nasdaq-100, especially the big tech players, can have a significant impact on QQQ. Strong earnings reports can boost the price, while disappointing results can drag it down.

How Does QQQ Compare to Other ETFs?

Now, you might be wondering how QQQ stacks up against other ETFs. The truth is, QQQ is in a league of its own. While other ETFs might focus on specific sectors or regions, QQQ gives you exposure to a diversified portfolio of tech-heavy companies. This diversification helps mitigate risk, making it a safer bet than investing in individual stocks.

But that’s not all. QQQ also has some of the lowest expense ratios in the ETF world, which means you keep more of your returns. Plus, its liquidity makes it easy to buy and sell, giving you flexibility in your investment strategy.

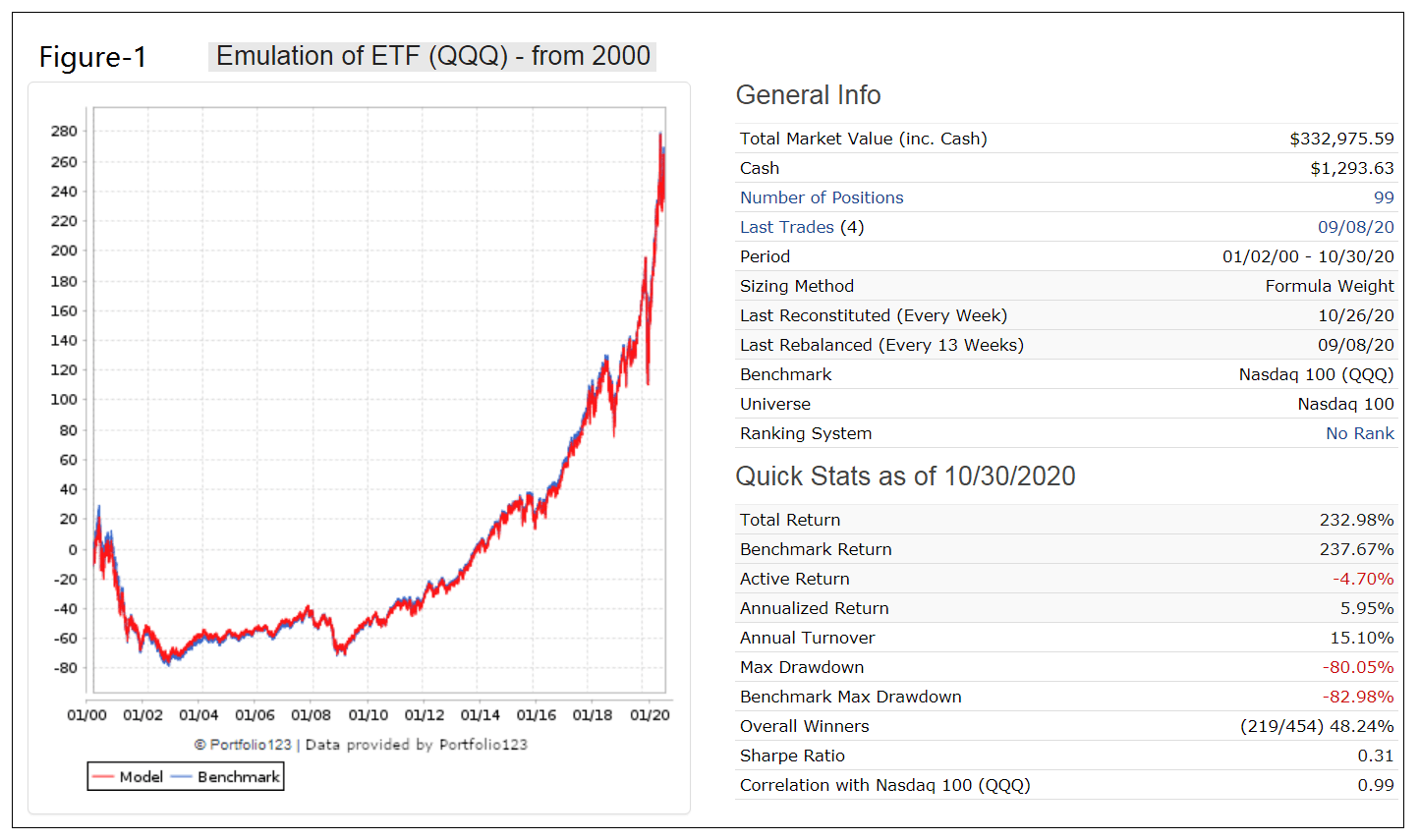

The Historical Performance of QQQ Stock Price

Looking at the historical performance of QQQ stock price can give you a better understanding of its potential. Over the past decade, QQQ has delivered impressive returns, outperforming many other ETFs and even the broader market. This is largely due to the strong performance of the tech sector, which has been a driving force behind economic growth.

Read also:Dhs Mistakenly Tells Ukrainian Refugees To Leave A Deep Dive Into The Controversy

However, it’s important to note that past performance is not indicative of future results. While QQQ has a solid track record, investing always comes with risks. That’s why it’s crucial to do your research and understand the factors that could impact QQQ stock price moving forward.

What Can We Learn from QQQ’s Past?

One of the most valuable lessons from QQQ’s history is the importance of diversification. By holding a basket of stocks, QQQ reduces the risk associated with investing in individual companies. This diversification has helped QQQ weather market storms and deliver consistent returns over the long term.

Another takeaway is the power of compounding. Even small increases in QQQ stock price can add up over time, especially if you reinvest your dividends. This is why many investors choose to hold QQQ as part of their long-term investment strategy.

QQQ Stock Price Today: What’s Happening Now?

As of today, QQQ stock price is hovering around [insert current price here]. But what’s driving the current movements? Let’s take a closer look:

- Tech Sector Growth: With innovation at an all-time high, the tech sector continues to drive QQQ’s performance. Companies like Apple and Microsoft are leading the charge, delivering strong earnings and pushing QQQ higher.

- Interest Rate Concerns: On the flip side, rising interest rates are causing some investors to pause. Higher rates can make borrowing more expensive, which could slow down growth for some companies in the Nasdaq-100.

- Global Uncertainty: Geopolitical tensions and supply chain disruptions are adding to the volatility. While QQQ has shown resilience in the face of these challenges, it’s important to stay vigilant.

What’s Next for QQQ Stock Price?

Predicting the future is always tricky, but there are some trends to watch. The tech sector is expected to continue growing, driven by advancements in artificial intelligence, cloud computing, and renewable energy. This could be a tailwind for QQQ, pushing its price higher.

However, there are also risks to consider. Economic slowdowns, regulatory changes, and market corrections could all impact QQQ stock price. That’s why it’s important to have a well-diversified portfolio and a long-term investment strategy.

How to Invest in QQQ Stock Price

Ready to jump into the world of QQQ investing? Here’s how you can get started:

- Open a Brokerage Account: You’ll need a brokerage account to buy and sell QQQ. There are plenty of options out there, from traditional brokers to online platforms. Choose one that fits your needs and budget.

- Set Your Investment Goals: Are you looking for short-term gains or long-term growth? Your goals will determine how you approach investing in QQQ.

- Monitor the Market: Keep an eye on the factors that influence QQQ stock price, such as economic indicators, corporate earnings, and global events. This will help you make informed decisions.

What Are the Risks?

While QQQ offers plenty of opportunities, it’s not without risks. The tech sector can be volatile, and QQQ is heavily influenced by the performance of a few large companies. This concentration risk means that if one or two companies stumble, it could drag down the entire ETF.

Additionally, market conditions can change rapidly, and unexpected events can impact QQQ stock price. That’s why it’s important to have a solid investment strategy and a risk management plan in place.

QQQ Stock Price Analysis: A Closer Look

To truly understand QQQ stock price, you need to analyze it from different angles. Here are a few key metrics to consider:

- Price-to-Earnings Ratio (P/E): This measures how much investors are willing to pay for each dollar of earnings. A high P/E ratio could indicate that QQQ is overvalued, while a low P/E might suggest it’s undervalued.

- Dividend Yield: QQQ pays dividends, which can add to your returns. The dividend yield is a good indicator of how much income you can expect from your investment.

- Volatility: QQQ can be volatile, especially during times of market uncertainty. Understanding its volatility can help you manage risk and make better investment decisions.

Technical Analysis vs. Fundamental Analysis

When it comes to analyzing QQQ stock price, there are two main approaches: technical analysis and fundamental analysis. Technical analysis focuses on price patterns and trends, using tools like charts and indicators to predict future movements. Fundamental analysis, on the other hand, looks at the underlying factors that drive QQQ, such as economic conditions and corporate earnings.

Both approaches have their merits, and many investors use a combination of the two to make informed decisions. It’s all about finding what works best for you and your investment goals.

QQQ Stock Price: A Long-Term Perspective

For those with a long-term outlook, QQQ offers a compelling opportunity. Its focus on the tech sector, combined with its diversification and low expense ratio, makes it an attractive option for building wealth over time. But remember, investing is a marathon, not a sprint. You need to be patient and disciplined to reap the rewards.

Here are a few tips for long-term QQQ investors:

- Stay Consistent: Stick to your investment strategy and avoid making impulsive decisions based on short-term market movements.

- Reinvest Dividends: This can help compound your returns over time, boosting your overall portfolio value.

- Review Regularly: Periodically review your portfolio to ensure it aligns with your goals and risk tolerance.

What About Inflation?

Inflation can impact QQQ stock price, especially if it leads to higher interest rates. However, tech companies tend to be more resilient to inflation, thanks to their ability to innovate and adapt. This could be a silver lining for QQQ investors, as the ETF is heavily weighted toward tech stocks.

Final Thoughts on QQQ Stock Price

In conclusion, QQQ stock price is a fascinating topic that offers insights into the health of the tech sector and the broader market. Whether you’re a short-term trader or a long-term investor, understanding QQQ can help you make smarter investment decisions.

So, what’s next? If you’ve found this article helpful, feel free to share it with your friends and family. And don’t forget to leave a comment below with your thoughts on QQQ stock price. We’d love to hear from you!

And if you’re ready to take the next step, why not explore our other articles on investing and finance? There’s always more to learn, and we’re here to help you along the way. Happy investing!

Table of Contents

- Understanding QQQ Stock Price

- What is QQQ Stock Price and Why Should You Care?

- Factors Influencing QQQ Stock Price

- How Does QQQ Compare to Other ETFs?

- The Historical Performance of QQQ Stock Price

- What Can We Learn from QQQ’s Past?

- QQQ Stock Price Today

- What’s Next for QQQ Stock Price?

- How to Invest in QQQ Stock Price

- What Are the Risks?

- QQQ Stock Price Analysis

- Technical Analysis vs. Fundamental Analysis

- QQQ Stock Price: A Long-Term Perspective

- What About Inflation?