Listen up, folks. If you’re into stocks and investments, INTC stock—or Intel Corporation—is one of those big names you can’t ignore. It’s like the Beyoncé of tech stocks—always in the spotlight, always making moves, and always worth talking about. Whether you’re a seasoned investor or just dipping your toes into the world of finance, understanding INTC stock could be your ticket to smarter financial decisions. Let’s dive in and break it down for you.

Now, I know what you’re thinking—“Why should I care about Intel?” Well, here’s the thing: Intel isn’t just another company; it’s a tech giant that’s been around for decades. They’ve been at the forefront of innovation, producing chips that power everything from your laptop to servers running entire data centers. So yeah, they’re kind of a big deal.

And if you’re looking to grow your portfolio, understanding INTC stock is crucial. It’s not just about buying shares—it’s about knowing the company, its potential, and where it’s headed. Ready to get the scoop? Let’s go!

Read also:Kevin Gates The Untold Story Of A Rising Hiphop Star

What Is INTC Stock Anyway?

Alright, let’s start with the basics. INTC stock represents ownership in Intel Corporation, one of the biggest semiconductor manufacturers in the world. Think of it this way: if the tech world had a heart, Intel would be the pump keeping it alive. Their processors are everywhere—you probably have one right now in your computer or phone.

Intel has been around since 1968, and over the years, they’ve played a huge role in shaping modern technology. The company’s focus on research and development has kept them at the cutting edge of innovation. But hey, don’t just take my word for it—let’s look at some numbers.

In 2022 alone, Intel generated over $63 billion in revenue. That’s a lot of cash, folks. And while they’ve faced some challenges lately, their long-term potential is still strong. If you’re looking for a stock that could deliver solid returns, INTC might just be the ticket.

Key Stats About Intel

- Founded: 1968

- Headquarters: Santa Clara, California

- Revenue in 2022: Over $63 billion

- Employees: Approximately 117,000

- Market Cap: Around $160 billion (as of 2023)

These numbers give you a pretty good idea of how massive Intel is. But remember, it’s not just about size—it’s about growth potential. And that’s where things get interesting.

Why Should You Care About INTC Stock?

Here’s the deal: INTC stock isn’t just about owning a piece of a big company. It’s about being part of a company that’s shaping the future of technology. With advancements in AI, cloud computing, and the Internet of Things (IoT), Intel is right there in the mix, driving innovation.

And let’s not forget the dividends. Yeah, you heard me—dividends. INTC stock pays out regular dividends, which means even if the stock price doesn’t skyrocket, you’re still getting paid just for owning it. Who doesn’t love free money, right?

Read also:Exploring The Rise And Legacy Of Erome Jamelizz A Deep Dive

But here’s the kicker: Intel isn’t resting on its laurels. They’ve got big plans for the future, including expanding into new markets and investing heavily in R&D. If you’re looking for a stock with staying power, INTC could be your golden ticket.

Dividends and Buybacks

Let’s talk dividends for a sec. INTC stock currently offers a dividend yield of around 3.5%, which is pretty solid compared to other tech stocks. And if that’s not enough, Intel has also been actively buying back shares, which is a great sign for investors.

When a company buys back its own shares, it shows confidence in its future. It also increases the value of the remaining shares, which is a win-win for shareholders. So yeah, INTC stock isn’t just about growth—it’s about income too.

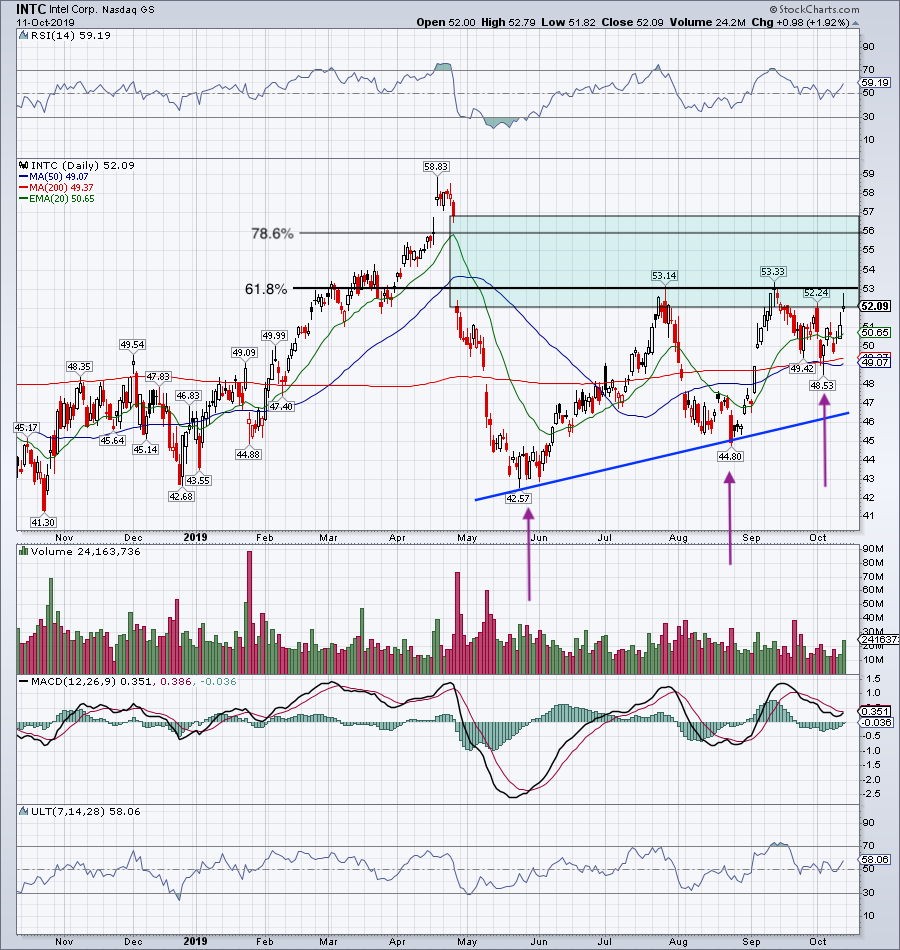

INTC Stock Performance Over the Years

Now, let’s take a look at how INTC stock has performed over the years. Spoiler alert: it’s been a rollercoaster ride. But hey, that’s the stock market for you—ups and downs, twists and turns.

Back in the early 2000s, INTC stock was flying high. The company was dominating the semiconductor market, and investors were loving it. But then came the 2008 financial crisis, and like many stocks, INTC took a hit. However, they bounced back stronger than ever.

In recent years, INTC stock has faced some challenges, including increased competition from companies like AMD and NVIDIA. But despite these hurdles, Intel has continued to innovate and adapt. And that’s what makes them so interesting as an investment.

Challenges Facing INTC Stock

Of course, no stock is without its challenges, and INTC is no exception. One of the biggest issues Intel has faced is competition from rivals like AMD and NVIDIA. These companies have been eating into Intel’s market share, particularly in the gaming and AI sectors.

But here’s the thing: Intel isn’t sitting around waiting to get beaten. They’re fighting back with new products, strategic partnerships, and aggressive marketing. And while the road ahead might be tough, I believe Intel has what it takes to stay on top.

What’s Next for INTC Stock?

So, where is INTC stock headed? That’s the million-dollar question, isn’t it? While no one can predict the future with 100% accuracy, there are some pretty solid clues pointing to a bright future for Intel.

First off, Intel is heavily invested in AI and cloud computing—two areas that are expected to explode in the coming years. With more and more companies moving to the cloud, Intel’s chips will be in high demand. And let’s not forget about 5G and the Internet of Things (IoT). These technologies are just getting started, and Intel is right there at the forefront.

Plus, Intel has a ton of cash on hand, which gives them the flexibility to make strategic acquisitions and investments. So yeah, the future looks pretty bright for INTC stock.

Innovation and Expansion

Intel isn’t just resting on its laurels—they’re actively innovating and expanding into new markets. One of their biggest moves recently has been their focus on foundry services. Essentially, they’re offering to manufacture chips for other companies, which could be a huge growth driver in the coming years.

And let’s not forget about their partnership with Apple. While Apple has moved away from Intel processors in their Mac lineup, Intel still supplies chips for many other devices. This diversification is key to their long-term success.

How to Invest in INTC Stock

Okay, so you’re convinced that INTC stock is worth a look. But how do you actually invest in it? Well, it’s pretty simple. All you need is a brokerage account. You can open one with pretty much any major brokerage firm, like Fidelity, Schwab, or E*TRADE.

Once you’ve got your account set up, just search for INTC stock and place your order. It’s as easy as that. And don’t worry if you don’t have a ton of money to invest—you can buy fractional shares, which means you can invest as little or as much as you want.

But here’s the thing: investing is all about research and due diligence. Make sure you understand the risks involved and have a solid investment strategy in place. And if you’re not sure where to start, consider consulting with a financial advisor.

Things to Consider Before Investing

Before you jump into INTC stock, there are a few things you should keep in mind. First off, Intel operates in a highly competitive industry. While they’re a leader in many areas, they also face stiff competition from companies like AMD and NVIDIA.

Secondly, the semiconductor industry is cyclical, meaning it goes through periods of boom and bust. This can make INTC stock more volatile than other stocks, so be prepared for some ups and downs.

Finally, always remember that past performance is no guarantee of future results. Just because Intel has been successful in the past doesn’t mean they’ll continue to be successful in the future. But hey, that’s the beauty of investing—it’s all about taking calculated risks.

Expert Insights on INTC Stock

Let’s take a look at what some experts are saying about INTC stock. According to analysts at J.P. Morgan, Intel is well-positioned for long-term growth, thanks to their focus on AI, cloud computing, and foundry services. They’ve also noted that Intel’s dividend yield makes it an attractive option for income investors.

Meanwhile, analysts at Morgan Stanley are bullish on INTC stock, citing the company’s strong financial position and commitment to innovation. They believe Intel has what it takes to regain market share and continue to grow in the coming years.

Of course, not everyone is a fan. Some analysts have raised concerns about Intel’s ability to compete with AMD and NVIDIA in certain markets. But hey, that’s the stock market for you—there’s always going to be differing opinions.

Analyst Ratings and Targets

As of 2023, the average price target for INTC stock is around $45 per share, with some analysts predicting even higher prices in the future. However, it’s important to remember that these targets are just estimates and can change based on market conditions.

That said, the majority of analysts covering INTC stock have a “buy” or “hold” rating, which is a good sign for investors. But as always, do your own research and make sure you’re comfortable with the risks involved.

Final Thoughts on INTC Stock

Alright, folks, that’s the scoop on INTC stock. Whether you’re a seasoned investor or just starting out, Intel is definitely a company worth watching. With their focus on innovation, strong financial position, and commitment to delivering value to shareholders, they’ve got all the ingredients for long-term success.

But remember, investing is all about doing your homework. Make sure you understand the risks involved and have a solid investment strategy in place. And if you’re not sure where to start, consider consulting with a financial advisor.

So, what do you think? Are you ready to jump into INTC stock? Or do you have questions? Leave a comment below and let’s chat. And don’t forget to share this article with your friends and family—knowledge is power, folks!

Conclusion

- INTC stock represents ownership in Intel Corporation, a tech giant shaping the future of technology.

- Intel offers solid dividends and has a strong focus on innovation and expansion.

- While challenges exist, Intel’s long-term potential remains strong, particularly in AI, cloud computing, and foundry services.

- Investing in INTC stock requires research and due diligence, but the rewards could be worth it.

So there you have it—a deep dive into INTC stock. Now it’s your turn to decide if Intel is the right investment for you. Good luck, and happy investing!

Table of Contents

- What Is INTC Stock Anyway?

- Why Should You Care About INTC Stock?

- INTC Stock Performance Over the Years

- Challenges Facing INTC Stock

- What’s Next for INTC Stock?

- Innovation and Expansion

- How to Invest in INTC Stock

- Things to Consider Before Investing

- Expert Insights on INTC Stock

- Final Thoughts on INTC Stock