Investing in Intel stock isn’t just about buying shares; it’s about tapping into one of the tech world's most iconic companies. The semiconductor giant has been around for decades, shaping how we interact with technology every single day. Whether you’re a seasoned investor or someone who’s just dipping their toes into the stock market, Intel offers a unique opportunity to grow your wealth while being part of an industry that’s driving global innovation.

Let’s face it, the world runs on chips. From your smartphone to your laptop, and even the self-driving cars that are becoming a reality, semiconductors power everything. And guess who’s been at the forefront of this revolution? Intel. This company isn’t just about making processors anymore; it’s about redefining what’s possible in tech. So, if you’re thinking about adding some spice to your portfolio, Intel might just be the ticket you’re looking for.

Now, before we dive deep into why Intel stock is worth considering, let’s set the stage. The stock market can be unpredictable, but investing in solid companies like Intel gives you a fighting chance to weather the storms. Plus, with the tech industry booming like never before, Intel’s position as a leader makes it a strong candidate for long-term growth. Ready to explore why Intel stock could be your next big move? Let’s get to it.

Read also:Kamala Harriss Message To Black Women Empowerment Resilience And Representation

Understanding Intel Stock

What is Intel Stock All About?

Intel stock represents ownership in Intel Corporation, a company that’s been around since 1968. It’s not just another player in the tech space; it’s a pioneer. When you buy Intel stock, you’re not just buying a piece of paper; you’re buying a stake in a company that’s been shaping the tech landscape for over 50 years. Think of it as being part of a legacy that’s still writing its next chapter.

Intel’s main game is designing and manufacturing semiconductor chips. These tiny powerhouses are the brains behind most of the tech we use daily. But here’s the kicker: Intel doesn’t just stop at chips. They’re also diving headfirst into areas like artificial intelligence, 5G technology, and autonomous driving. This diversification makes Intel stock an exciting prospect for investors looking to capitalize on the future of tech.

And let’s not forget the dividends. Intel has a history of rewarding its shareholders with regular payouts. While dividends aren’t guaranteed, they’re a nice little bonus for those who prefer a more passive income stream from their investments. It’s like getting a little thank-you note from Intel for believing in them.

Why Intel Stock Stands Out

Key Factors That Make Intel Stock a Strong Bet

There are several reasons why Intel stock is often considered a solid investment. First off, Intel has a strong brand presence. When people think of tech, Intel’s name often comes to mind. This brand recognition translates into a loyal customer base and a competitive edge in the market.

Another big plus is Intel’s financial health. The company consistently reports robust revenue numbers, and its balance sheet is as solid as they come. This financial stability gives investors peace of mind, knowing that Intel is well-positioned to handle any market fluctuations.

But wait, there’s more. Intel’s commitment to R&D is unmatched. They pour billions into research and development every year, ensuring they stay ahead of the curve in a rapidly evolving industry. This forward-thinking approach not only keeps them innovative but also opens up new revenue streams, making Intel stock an attractive option for growth-oriented investors.

Read also:Bill Burr The Unfiltered Comedy Genius With A Razorsharp Wit

Intel Stock Performance

Tracking Intel Stock’s Journey

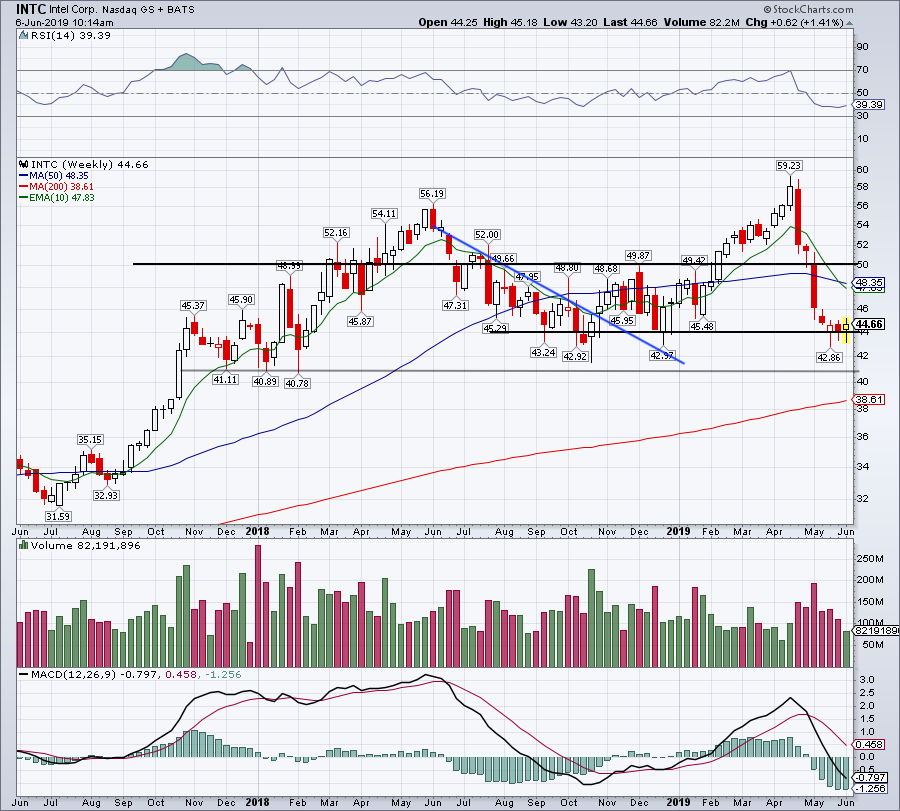

When it comes to Intel stock performance, the numbers don’t lie. Over the years, Intel has shown steady growth, with occasional dips here and there. But that’s the nature of the stock market. What sets Intel apart is its ability to bounce back stronger from these dips, thanks to its strategic investments and market positioning.

Take a look at Intel’s stock performance over the past decade. You’ll notice a pattern of consistent upward movement, punctuated by strategic pivots that have kept the company relevant. For instance, Intel’s shift towards AI and cloud computing has been a game-changer, opening up new avenues for growth and diversification.

And let’s talk about volatility. Intel stock isn’t immune to market fluctuations, but its long-term performance speaks volumes. Investors who’ve held onto Intel stock for the long haul have generally seen positive returns. This resilience makes Intel stock a favorite among both conservative and aggressive investors alike.

Market Trends and Intel Stock

How Market Trends Impact Intel Stock

The tech industry is constantly evolving, and Intel stock is no exception. Current market trends, such as the rise of AI, the proliferation of IoT devices, and the push towards sustainable tech, are all factors that influence Intel’s trajectory. By staying ahead of these trends, Intel ensures its stock remains relevant and attractive to investors.

One trend that’s particularly noteworthy is the shift towards edge computing. As more devices become connected, the need for powerful, efficient processors increases. Intel is well-positioned to capitalize on this demand, thanks to its extensive portfolio of cutting-edge products. This alignment with market needs makes Intel stock a smart choice for those looking to ride the wave of tech innovation.

Moreover, global initiatives towards sustainability are pushing companies like Intel to innovate in ways that reduce their carbon footprint. Intel’s commitment to green tech not only aligns with global goals but also enhances its brand image, making Intel stock even more appealing to socially conscious investors.

Risk Factors in Intel Stock

Understanding the Risks

No investment is without risks, and Intel stock is no exception. One of the main risks is competition. The semiconductor industry is highly competitive, with players like AMD and NVIDIA constantly vying for market share. Intel’s ability to maintain its edge in this competitive landscape is crucial for its stock performance.

Another risk factor is geopolitical tensions. Trade policies and international relations can significantly impact Intel’s operations and profitability. For instance, trade restrictions or tariffs could affect Intel’s supply chain, leading to potential disruptions that might impact its stock price.

Lastly, technological obsolescence is always a concern. In an industry that moves as fast as tech, staying relevant is key. Intel must continue to innovate and adapt to changing market demands to ensure its stock remains a viable investment option.

Investor Sentiment on Intel Stock

What Investors Think About Intel Stock

Investor sentiment towards Intel stock is generally positive, though it does fluctuate based on market conditions and company announcements. Many investors appreciate Intel’s strong financials and its leadership position in the semiconductor industry. However, there’s also a segment of investors who are cautious, citing concerns about competition and market dynamics.

Analyst opinions vary, but the consensus is that Intel stock remains a solid investment. Some analysts highlight Intel’s potential for growth in emerging tech sectors, while others focus on its steady dividend payments. This mixed sentiment reflects the broader market’s view of Intel as both a safe haven and an opportunity for growth.

Moreover, retail investors, often referred to as the ‘Robinhood generation,’ have shown increasing interest in Intel stock. This new wave of investors sees value in Intel’s brand and its potential to benefit from ongoing tech trends. Their enthusiasm adds another layer to the overall investor sentiment surrounding Intel stock.

Financial Metrics of Intel Stock

Key Financial Indicators

When evaluating Intel stock, several financial metrics are worth considering. First up is the price-to-earnings ratio (P/E). Intel’s P/E ratio is generally lower than its peers, indicating that the stock might be undervalued. This can be a good sign for investors looking for bargains in the tech sector.

Next, let’s talk about revenue growth. Intel consistently reports strong revenue numbers, driven by its diverse product portfolio and strategic market positioning. This steady growth is a testament to Intel’s ability to adapt and thrive in an ever-changing tech landscape.

Lastly, don’t overlook the importance of cash flow. Intel generates substantial cash flow, which it uses for R&D, dividends, and share buybacks. This strong cash flow not only supports Intel’s operations but also enhances shareholder value, making Intel stock an attractive option for those seeking both growth and income.

Future Prospects for Intel Stock

Where is Intel Stock Headed?

The future looks bright for Intel stock. With ongoing advancements in AI, 5G, and autonomous driving, Intel is poised to capitalize on these emerging trends. The company’s strategic investments in these areas position it well for long-term growth and profitability.

Moreover, Intel’s focus on sustainability and green tech aligns with global initiatives, enhancing its brand image and market appeal. As more investors seek socially responsible investment options, Intel’s commitment to these values could further boost its stock performance.

Additionally, Intel’s ongoing efforts to enhance its manufacturing capabilities and expand its market reach are promising signs. These initiatives not only strengthen Intel’s competitive position but also open up new opportunities for revenue growth, making Intel stock a compelling choice for forward-thinking investors.

Expert Insights on Intel Stock

What the Experts Say

Industry experts and financial analysts have a lot to say about Intel stock. Many agree that Intel’s strong financials, coupled with its leadership in the semiconductor industry, make it a solid investment. However, they also caution about the competitive landscape and the need for continuous innovation.

Some experts highlight Intel’s potential in emerging tech sectors, such as AI and 5G, as key drivers for future growth. They see Intel’s strategic investments in these areas as a smart move that could pay off in the long run. Others emphasize the importance of Intel’s brand and its ability to innovate, which they believe will continue to attract investors.

Overall, the expert consensus is that Intel stock remains a strong contender in the tech sector, with plenty of opportunities for growth and value creation. Their insights provide valuable context for investors considering adding Intel to their portfolio.

Conclusion: Is Intel Stock Right for You?

In summary, Intel stock offers a compelling investment opportunity for those looking to tap into the tech industry’s growth potential. Its strong financials, leadership position, and commitment to innovation make it a solid choice for both long-term and growth-oriented investors.

Whether you’re drawn to its brand, its dividends, or its potential in emerging tech sectors, Intel stock has something to offer everyone. So, if you’re ready to take the plunge and add some tech firepower to your portfolio, Intel might just be the stock you’ve been waiting for.

Don’t just sit on the sidelines; take action! Leave a comment, share this article, or check out more insights on tech stocks. The future of tech is here, and Intel stock could be your ticket to it. Let’s make it happen!

Table of Contents:

- Why Intel Stock is a Smart Investment for Your Portfolio

- Understanding Intel Stock

- What is Intel Stock All About?

- Why Intel Stock Stands Out

- Key Factors That Make Intel Stock a Strong Bet

- Intel Stock Performance

- Tracking Intel Stock’s Journey

- Market Trends and Intel Stock

- How Market Trends Impact Intel Stock

- Risk Factors in Intel Stock

- Understanding the Risks

- Investor Sentiment on Intel Stock

- What Investors Think About Intel Stock

- Financial Metrics of Intel Stock

- Key Financial Indicators

- Future Prospects for Intel Stock

- Where is Intel Stock Headed?

- Expert Insights on Intel Stock

- What the Experts Say

- Conclusion: Is Intel Stock Right for You?