Let’s be real, buying a home is one of the biggest financial decisions you’ll ever make. And when it comes to financing, Chase FHA Loan might just be your golden ticket. Whether you’re a first-time buyer or looking to refinance, this loan option offers flexibility and affordability that’s hard to beat. So, buckle up, because we’re diving deep into everything you need to know about Chase FHA Loans and how they can help you achieve homeownership dreams.

Imagine this: you’ve found the perfect house, the one with the big backyard and sunlight streaming through the windows. But there’s one problem – you don’t have a massive down payment lying around. Enter Chase FHA Loans. These loans are designed to make homeownership accessible to more people by requiring as little as 3.5% down. It’s like the mortgage world’s version of a superhero cape, swooping in to save the day.

But hold up, before we get too carried away, let’s break it down. In this article, we’ll explore what Chase FHA Loans are, how they work, and why they’re worth considering. We’ll also cover the application process, eligibility requirements, and some common questions people have. Think of this as your go-to guide for navigating the sometimes confusing world of home loans. Let’s get started!

Read also:Kamala Harriss Message To Black Women Empowerment Resilience And Representation

What Exactly is a Chase FHA Loan?

A Chase FHA Loan is essentially a mortgage product offered by Chase Bank that is insured by the Federal Housing Administration (FHA). This means that if you default on your loan, the FHA will reimburse Chase for any losses. It’s kind of like an insurance policy for the lender, which allows them to offer more lenient terms to borrowers. The result? Lower down payments and more flexible credit requirements.

Now, here’s the kicker – FHA loans are specifically designed to help people who might not qualify for conventional loans. That includes first-time buyers, folks with less-than-perfect credit, and those who don’t have a ton of cash saved up. Chase FHA Loans combine the reliability of Chase Bank with the accessibility of FHA backing, making them a great option for many buyers.

Why Choose Chase for Your FHA Loan?

When it comes to choosing a lender for your FHA loan, Chase has a lot to offer. First off, they’re one of the biggest and most reputable banks in the country. That means you can trust them to handle your loan with care. Plus, they have a ton of experience with FHA loans, so you know you’re in good hands.

Another big perk is their online application process. In today’s digital world, being able to apply for a loan from the comfort of your couch is a huge plus. Chase makes it easy to submit all your documents and track the progress of your application. And if you have any questions along the way, their customer service team is just a phone call away.

Eligibility Requirements for Chase FHA Loans

Okay, so you’re interested in a Chase FHA Loan, but are you eligible? Let’s break it down. First things first, you’ll need to meet some basic requirements. These include having a minimum credit score of 580 for the 3.5% down payment option, or 500 if you’re willing to put down 10%. Yep, even if your credit isn’t perfect, you might still qualify.

In addition to credit score, Chase will also look at your debt-to-income ratio. Ideally, this should be below 43%, but there are exceptions. They’ll also want to see proof of steady income, so be prepared to provide pay stubs or tax returns. And finally, you’ll need to complete a homebuyer education course if you’re a first-time buyer.

Read also:Sela Ward The Iconic Journey Of A True Hollywood Star

Key Eligibility Checklist

- Minimum credit score of 580 for 3.5% down payment

- Steady income with proof of employment

- Debt-to-income ratio below 43%

- Completion of homebuyer education course (for first-time buyers)

How Do Chase FHA Loans Work?

Alright, let’s talk about the nitty-gritty of how Chase FHA Loans actually work. Once you’ve determined that you’re eligible, the next step is to apply. This involves gathering all your financial documents, including pay stubs, tax returns, and bank statements. You’ll also need to provide information about the property you’re looking to purchase.

After you submit your application, Chase will review it and decide whether to approve you for the loan. If you’re approved, you’ll receive a loan estimate outlining the terms of the loan, including the interest rate and monthly payments. From there, you’ll work with a loan officer to finalize the details and close on the loan.

Step-by-Step Application Process

- Gather all necessary financial documents

- Submit your application online or in-person

- Wait for Chase to review your application

- Receive a loan estimate and finalize details

- Close on the loan and get the keys to your new home

Benefits of Chase FHA Loans

So, why should you choose a Chase FHA Loan over other mortgage options? There are several key benefits that make these loans stand out. First and foremost is the low down payment requirement. With as little as 3.5% down, you can buy a home without having to save up for years.

Another big advantage is the flexibility in credit requirements. Unlike conventional loans, which often require a credit score of 620 or higher, Chase FHA Loans allow borrowers with lower scores to qualify. And let’s not forget the added security of FHA insurance, which gives lenders peace of mind and allows them to offer more favorable terms.

Top 5 Benefits

- Low down payment requirement (3.5%)

- Flexible credit score requirements

- FHA insurance for added security

- Competitive interest rates

- Reputable lender with great customer service

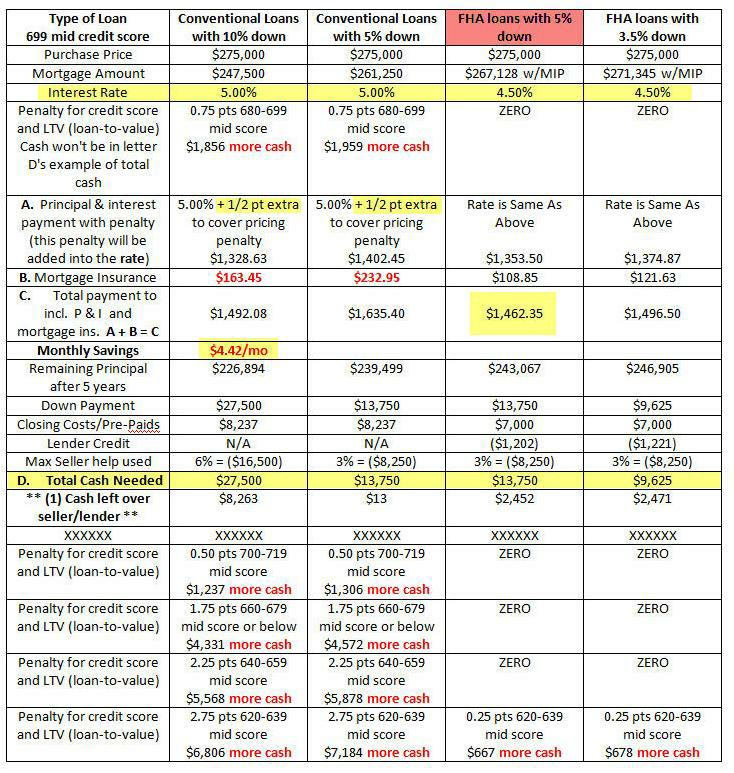

Chase FHA Loan Rates and Fees

Now, let’s talk money. What kind of rates and fees can you expect with a Chase FHA Loan? Well, it depends on a few factors, including your credit score, the size of your down payment, and current market conditions. That said, Chase FHA Loans typically offer competitive interest rates compared to conventional loans.

One thing to keep in mind is the FHA mortgage insurance premium (MIP). This is a fee that all FHA borrowers must pay, both upfront and annually. The exact amount will depend on the loan term and the size of your down payment. But don’t worry, Chase will walk you through all the fees and make sure you understand them before you sign on the dotted line.

Common Fees and Costs

- Upfront mortgage insurance premium (MIP)

- Annual MIP payments

- Closing costs (typically 3-5% of the loan amount)

- Loan origination fee

Common Questions About Chase FHA Loans

We’ve covered a lot of ground so far, but you might still have some questions. Here are some of the most common ones people ask about Chase FHA Loans:

Can I Use a Chase FHA Loan for Investment Properties?

Nope, Chase FHA Loans are specifically designed for primary residences. If you’re looking to buy a rental property or second home, you’ll need to explore other loan options.

What Happens if I Default on My Loan?

If you default on your Chase FHA Loan, the FHA will step in to reimburse Chase for their losses. However, this doesn’t mean you’re off the hook. Defaulting on a mortgage can have serious consequences, including damage to your credit score and potential foreclosure.

Final Thoughts and Call to Action

Alright, we’ve reached the end of our deep dive into Chase FHA Loans. To sum it up, these loans are a great option for anyone looking to buy a home with a low down payment and flexible credit requirements. Whether you’re a first-time buyer or looking to refinance, Chase FHA Loans offer a ton of benefits that make homeownership more accessible.

So, what’s next? If you think a Chase FHA Loan might be right for you, take the next step and start gathering your financial documents. Then, head over to Chase’s website or visit a local branch to apply. And don’t forget to share this article with anyone else who might find it helpful. Homeownership is within reach – all it takes is a little knowledge and determination.

Table of Contents

- What Exactly is a Chase FHA Loan?

- Why Choose Chase for Your FHA Loan?

- Eligibility Requirements for Chase FHA Loans

- How Do Chase FHA Loans Work?

- Benefits of Chase FHA Loans

- Chase FHA Loan Rates and Fees

- Common Questions About Chase FHA Loans

- Final Thoughts and Call to Action