So, you're thinking about buying a house? That's huge, man. Like, really huge. Let's break it down for ya. First things first, you gotta know that getting a chase mortgage pre-approval is like the golden ticket to your dream home. It’s not just about saying, "Hey, I want a house." It’s about proving you’re serious and ready to roll. This process gives you the edge in a competitive market, and trust me, that’s a big deal.

Now, let’s talk numbers. According to recent stats, over 70% of homebuyers go through some form of pre-approval before closing a deal. And guess what? Chase is one of the top dogs in this game. They’ve got the experience, the resources, and the know-how to make your mortgage dreams come true. But, there’s a catch. You need to understand how it works, and that’s exactly what we’re gonna dive into here.

So, buckle up, because we’re about to break down everything you need to know about chase mortgage pre-approval. From the basics to the nitty-gritty details, we’ve got you covered. Let’s make sure you’re not just dreaming about that house but actually stepping into it with confidence. Ready? Let’s go!

Read also:Erome Camila Araujo The Rising Star In Digital Influence

Table of Contents:

- What is Chase Mortgage Pre-Approval?

- Why is Chase Mortgage Pre-Approval Important?

- The Chase Mortgage Pre-Approval Process

- Documents You’ll Need for Chase Mortgage Pre-Approval

- How Your Credit Score Affects Chase Mortgage Pre-Approval

- Understanding Chase Mortgage Interest Rates

- Types of Loans Chase Offers

- Common Mistakes to Avoid During Chase Mortgage Pre-Approval

- Tips for a Successful Chase Mortgage Pre-Approval

- Wrapping It Up

What is Chase Mortgage Pre-Approval?

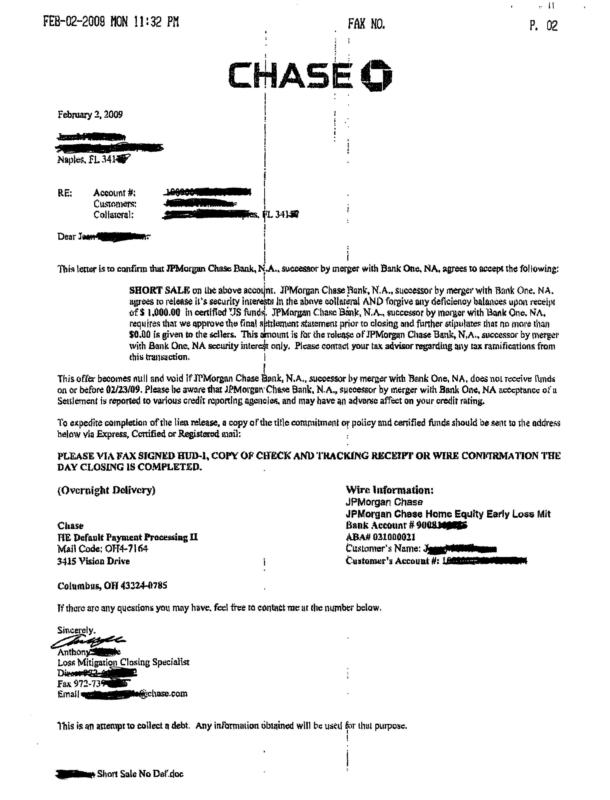

Alright, let’s start with the basics. A chase mortgage pre-approval is essentially a letter from Chase that says, "Hey, we’ve looked at your finances, and we think you’re a pretty solid candidate for a mortgage." It’s not a guarantee, but it’s a strong indicator that you’re in the running. This letter will tell you how much you can borrow and under what terms.

Think of it like a job interview. You’ve done your homework, you’ve got the skills, and now you’re just waiting for the official offer. Chase will review your financial history, income, and credit score to determine how much they’re willing to lend you. And guess what? This whole process can usually be done online, which is super convenient in today’s fast-paced world.

Why is Chase Mortgage Pre-Approval Important?

Here’s the deal. In today’s competitive housing market, having a chase mortgage pre-approval is like carrying a cheat code. Sellers love it because it shows you’re serious and financially stable. Real estate agents love it because it makes the process smoother. And you? Well, you’ll love it because it gives you peace of mind.

Plus, it helps you set realistic expectations. You won’t waste time looking at houses that are out of your budget. Instead, you’ll focus on the ones that fit your financial situation perfectly. And let’s be honest, who doesn’t want that?

The Chase Mortgage Pre-Approval Process

So, how does the chase mortgage pre-approval process work? It’s pretty straightforward, actually. First, you’ll need to fill out an application. This can be done online or in person, depending on your preference. Chase will then review your financial information, including your income, assets, and credit history.

Read also:Commanders Announce Star Wr Update Breaking News Every Fan Needs To Know

Once they’ve got all the details, they’ll crunch the numbers and send you a pre-approval letter. This whole process usually takes a few days, but sometimes it can be done in as little as 24 hours. And hey, who doesn’t love speed when it comes to buying a house?

Steps to Get Pre-Approved

- Fill out the application form

- Submit your financial documents

- Wait for Chase to review your application

- Receive your pre-approval letter

Documents You’ll Need for Chase Mortgage Pre-Approval

Now, let’s talk about the paperwork. You’ll need to gather a few key documents to get your chase mortgage pre-approval. These include:

- Proof of income (pay stubs, W-2 forms, or tax returns)

- Bank statements

- Proof of assets (savings, investments, etc.)

- Identification (driver’s license, passport, etc.)

- Credit report

Make sure everything is up-to-date and organized. The smoother this part goes, the quicker you’ll get that pre-approval letter.

How Your Credit Score Affects Chase Mortgage Pre-Approval

Your credit score plays a huge role in the chase mortgage pre-approval process. Lenders use it to assess your creditworthiness. Generally, a higher credit score means better terms and lower interest rates. Chase typically looks for a score of at least 620, but the higher, the better.

If your credit score needs a little boost, don’t panic. There are steps you can take to improve it, like paying down debt or disputing errors on your credit report. Just remember, this won’t happen overnight, so plan ahead.

Understanding Chase Mortgage Interest Rates

Interest rates are another crucial factor in the chase mortgage pre-approval process. They can vary based on several factors, including your credit score, the type of loan, and current market conditions. Chase offers both fixed and adjustable-rate mortgages, so it’s important to understand the differences.

Fixed-rate mortgages have a set interest rate for the life of the loan, which can provide stability. Adjustable-rate mortgages, on the other hand, have rates that can change over time, potentially saving you money if rates decrease.

Types of Loans Chase Offers

Chase offers a variety of mortgage options to suit different needs. Here are a few:

- Conventional Loans: Best for buyers with good credit and a solid down payment.

- FHA Loans: Ideal for first-time buyers with lower credit scores.

- VA Loans: Available to eligible veterans and active-duty service members.

- Jumbo Loans: For buyers looking at high-value properties.

Each type has its own set of requirements and benefits, so it’s important to choose the one that fits your situation best.

Common Mistakes to Avoid During Chase Mortgage Pre-Approval

Let’s talk about what not to do. There are a few common mistakes people make during the chase mortgage pre-approval process. Here are some to watch out for:

- Not checking your credit score beforehand

- Applying for new credit during the process

- Not gathering all necessary documents

- Underestimating your budget

By avoiding these pitfalls, you’ll increase your chances of a smooth and successful pre-approval.

Tips for a Successful Chase Mortgage Pre-Approval

Here are a few tips to help you nail that chase mortgage pre-approval:

- Start early. Don’t wait until the last minute to apply.

- Be honest about your finances. Lenders will find out if you’re not truthful.

- Shop around. Compare Chase’s rates and terms with other lenders.

- Stay organized. Keep all your documents in one place.

Following these tips will make the process much easier and less stressful.

Wrapping It Up

So, there you have it. Everything you need to know about chase mortgage pre-approval. From understanding the process to avoiding common mistakes, we’ve covered it all. Remember, this is a big step, but with the right preparation and mindset, you can make it happen.

Now, here’s the deal. If you’ve found this info helpful, drop a comment below. Share it with your friends who might be in the market for a new home. And hey, if you’re ready to take the next step, head over to Chase’s website and start that application. Your dream home is waiting!