Looking to buy a house but not sure where to start? Chase mortgage preapproval could be your golden ticket. Think of it as a warm handshake from the bank, saying "we believe in you and your dream home." But what exactly does it mean, and why should you care? Let's dive in and break it down for you, because buying a house isn’t just about finding the perfect kitchen or backyard—it’s about securing your future.

Buying a house is one of the biggest financial decisions you’ll ever make. It’s like picking a life partner, except this one comes with a mortgage. Chase mortgage preapproval gives you an edge in the real estate game by showing sellers that you’re serious and financially ready to take the leap. In today’s competitive market, having that preapproval letter is like carrying a magic wand that opens doors—literally.

But hold up! Before you go running to Chase, there are a few things you need to know. This article will walk you through everything you need to get preapproved, what lenders look for, and how to make the process smoother than butter. So grab a coffee, sit back, and let’s get into it.

Read also:Pining For Kim Animation A Deep Dive Into The World Of Retro Gaming

Why Chase Mortgage Preapproval Matters

Let’s face it—real estate is a cutthroat world. Sellers want to know you’re legit before they even consider letting you step foot inside their dream home. That’s where Chase mortgage preapproval comes in. It’s like a VIP pass that says, “Hey, I’ve been vetted, and I can afford this house.” This little piece of paper can give you a serious edge over other buyers who haven’t taken the time to get preapproved.

Here’s the deal: when you’re preapproved, lenders have already reviewed your financials and determined how much they’re willing to lend you. This means you’ll know your budget upfront, so you’re not wasting time looking at houses that are out of your price range. Plus, it shows sellers that you’re serious and ready to close the deal.

What Does Chase Look For in Preapproval?

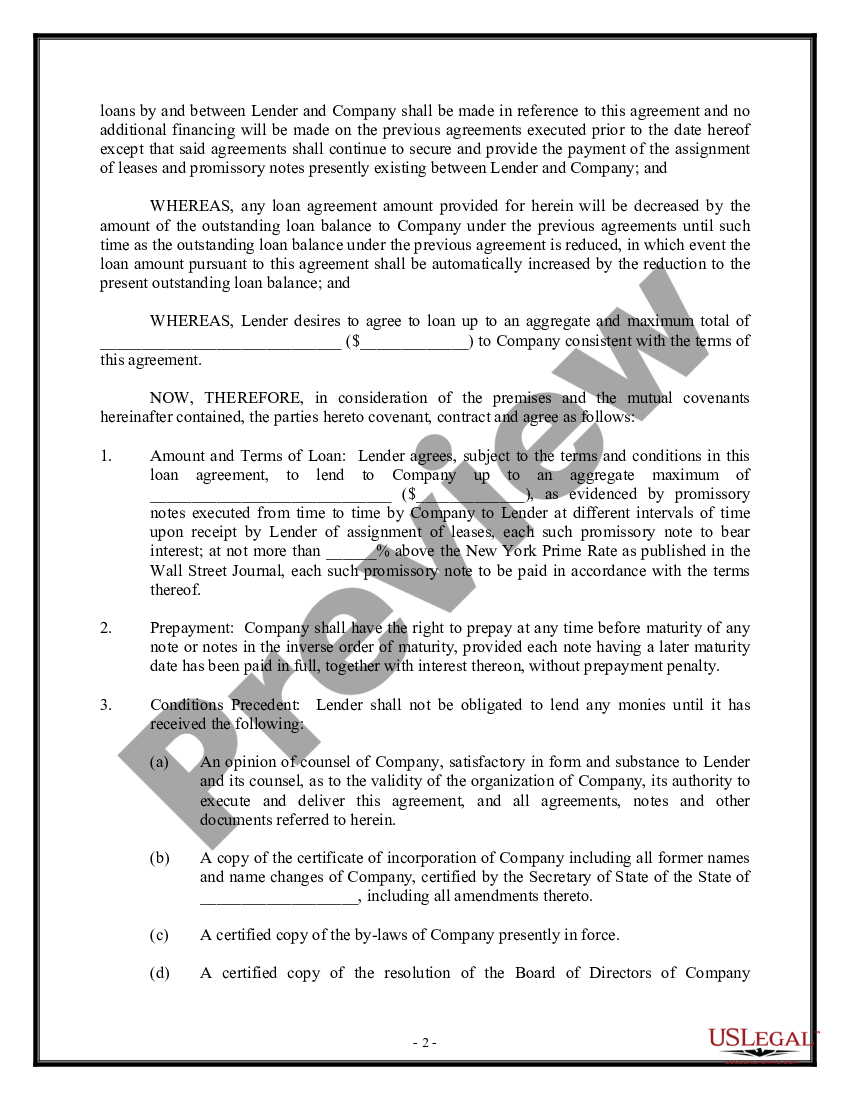

Chase isn’t just handing out preapproval letters to anyone who walks through their doors. They want to make sure you’re a good risk. So, what exactly are they looking for? Here’s the lowdown:

- Credit Score: Your credit score is like your financial report card. The higher it is, the better your chances of getting a good interest rate.

- Income Stability: Lenders want to see that you’ve got a steady income. This means they’ll be checking your employment history and tax returns.

- Debt-to-Income Ratio (DTI): Your DTI ratio is the percentage of your monthly income that goes toward paying debts. Chase likes to see this number under 43%.

- Down Payment: The more you can put down, the better. It shows lenders that you’re committed and reduces their risk.

Think of it like this—if you were lending someone money, wouldn’t you want to know they could pay you back? Chase is no different. They want to make sure you’re a safe bet before they give you the green light.

How to Get Chase Mortgage Preapproval

Alright, so you’re ready to take the plunge. Here’s how you can get Chase mortgage preapproval in just a few simple steps:

Gather Your Documents

Before you even think about applying, you’ll need to gather some key documents. Think of it like packing for a trip—you don’t want to forget anything important. Here’s what you’ll need:

Read also:Willem De Schryver Partner A Deep Dive Into His Career Achievements And Impact

- Two years of W-2 forms or tax returns

- Recent pay stubs

- Bank statements from the past two months

- Any other financial documents they might request

Having all your ducks in a row will make the process smoother and faster. Trust me, you don’t want to be scrambling for paperwork at the last minute.

Apply Online or In-Person

Once you’ve got your documents ready, it’s time to apply. You can do this either online or by visiting a Chase branch. Applying online is super convenient, especially if you’ve got a busy schedule. Just log into your Chase account, fill out the application, and upload your documents. If you prefer the personal touch, head to your local branch and speak to a mortgage specialist.

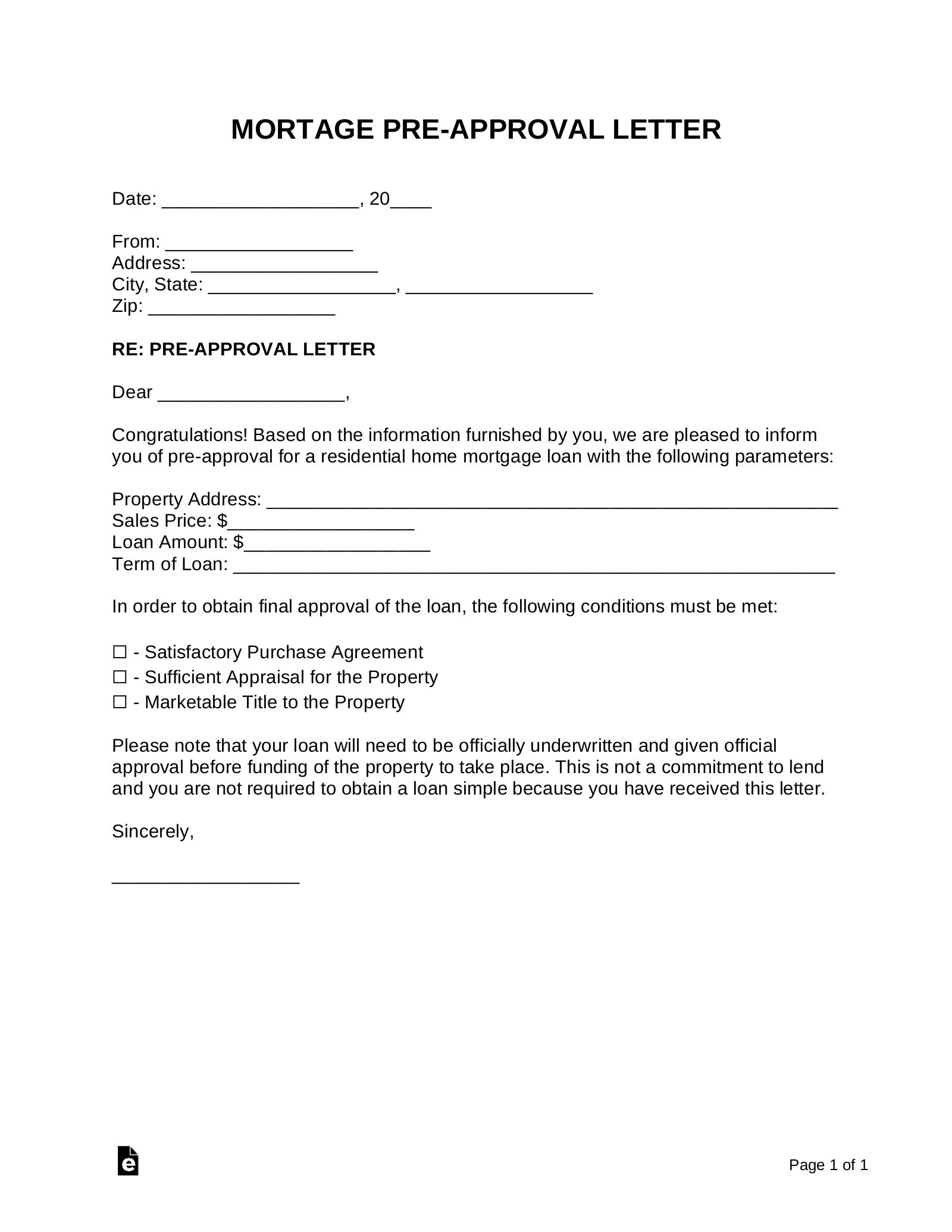

Review Your Preapproval Letter

After you’ve applied, Chase will review your information and decide whether to preapprove you. If you’re approved, you’ll receive a preapproval letter that outlines how much you’re eligible to borrow. This letter is your golden ticket to the real estate market, so keep it safe.

Understanding the Chase Mortgage Preapproval Process

Now that you know how to get preapproved, let’s talk about what happens behind the scenes. When you apply for Chase mortgage preapproval, they’ll review several factors to determine your eligibility. This includes your credit score, income, debt-to-income ratio, and down payment amount.

Chase uses this information to assess your financial health and decide how much they’re willing to lend you. They’ll also look at the type of property you’re interested in buying, as this can affect your loan terms. For example, buying a single-family home might come with different requirements than purchasing a condo.

What to Expect During the Process

The preapproval process can take anywhere from a few days to a couple of weeks, depending on how quickly you can provide the necessary documents. During this time, Chase will verify your information and run a credit check. Once they’ve reviewed everything, they’ll let you know if you’re approved and how much you can borrow.

Don’t worry if you don’t get approved right away. Sometimes, lenders need more information or want to see a few things improve, like your credit score or DTI ratio. Use this as an opportunity to strengthen your financial position and reapply when you’re ready.

Benefits of Chase Mortgage Preapproval

Getting Chase mortgage preapproval comes with a host of benefits that can make your home-buying journey smoother and more successful. Here are just a few:

- Know Your Budget: Preapproval gives you a clear idea of how much house you can afford, so you’re not wasting time on properties that are out of reach.

- Competitive Edge: In a competitive market, having a preapproval letter can set you apart from other buyers who haven’t taken this step.

- Peace of Mind: Knowing you’re preapproved can give you confidence during the home-buying process, knowing you’re financially ready to take the plunge.

Think of it like this—would you go grocery shopping without a list? Probably not. Getting preapproved is like creating a shopping list for your dream home. It keeps you focused and helps you avoid unnecessary temptations.

Common Misconceptions About Chase Mortgage Preapproval

There are a few common misconceptions about Chase mortgage preapproval that we need to clear up. Let’s bust some myths:

Preapproval is the Same as Final Approval

Wrong! Preapproval is just the first step. It shows that you’re likely to be approved for a mortgage, but it’s not a guarantee. Final approval comes after the lender has completed all their due diligence, including appraisals and inspections.

Preapproval Means You’re Committed

Not true! Getting preapproved doesn’t mean you’re obligated to take out a mortgage with Chase. You’re still free to shop around and compare rates with other lenders.

Preapproval is Only for First-Time Buyers

Another myth! Anyone can benefit from getting preapproved, whether you’re a first-time buyer or a seasoned homeowner looking to upgrade.

How Chase Mortgage Preapproval Fits Into the Bigger Picture

Buying a house is more than just finding the right property. It’s about securing your financial future and building equity. Chase mortgage preapproval is a crucial step in this process because it sets the foundation for your home-buying journey.

Think of it like building a house. You wouldn’t start constructing the walls without first laying a solid foundation, right? The same goes for buying a house. Getting preapproved is like laying that foundation—it gives you a strong starting point and sets you up for success.

Building Equity and Wealth

When you buy a house, you’re not just getting a place to live. You’re also building equity, which can be a valuable asset in the future. Over time, as you pay down your mortgage and the value of your home increases, your equity grows. This can provide financial security and open up opportunities for future investments.

Top Tips for a Successful Chase Mortgage Preapproval

Ready to ace your Chase mortgage preapproval? Here are some top tips to help you succeed:

- Boost Your Credit Score: Pay down debts, make payments on time, and avoid opening new credit accounts before applying.

- Save for a Down Payment: The more you can put down, the better your chances of getting a good interest rate.

- Keep Your Job: Lenders like to see stability, so try to avoid switching jobs before applying.

- Stay Organized: Keep all your financial documents in one place so you can easily access them when needed.

Remember, the more prepared you are, the smoother the process will be. Treat it like a marathon, not a sprint. Take your time to get everything in order before you apply.

Conclusion: Take the First Step Toward Homeownership

Chase mortgage preapproval is a crucial step in the home-buying process that can set you up for success. By getting preapproved, you’ll know your budget, gain a competitive edge, and have peace of mind knowing you’re financially ready to take the plunge. So, what are you waiting for? Take the first step toward homeownership and start your journey today.

Don’t forget to leave a comment or share this article with your friends who might be in the market for a new home. And if you’ve got any questions or need further advice, feel free to reach out. Happy house hunting!

Table of Contents

- Chase Mortgage Preapproval: Your Key to Unlocking Homeownership Dreams

- Why Chase Mortgage Preapproval Matters

- What Does Chase Look For in Preapproval?

- How to Get Chase Mortgage Preapproval

- Gather Your Documents

- Apply Online or In-Person

- Review Your Preapproval Letter

- Understanding the Chase Mortgage Preapproval Process

- What to Expect During the Process

- Benefits of Chase Mortgage Preapproval

- Common Misconceptions About Chase Mortgage Preapproval

- Preapproval is the Same as Final Approval

- Preapproval Means You’re Committed

- Preapproval is Only for First-Time Buyers

- How Chase Mortgage Preapproval Fits Into the Bigger Picture

- Building Equity and Wealth

- Top Tips for a Successful Chase Mortgage Preapproval

- Conclusion: Take the First Step Toward Homeownership